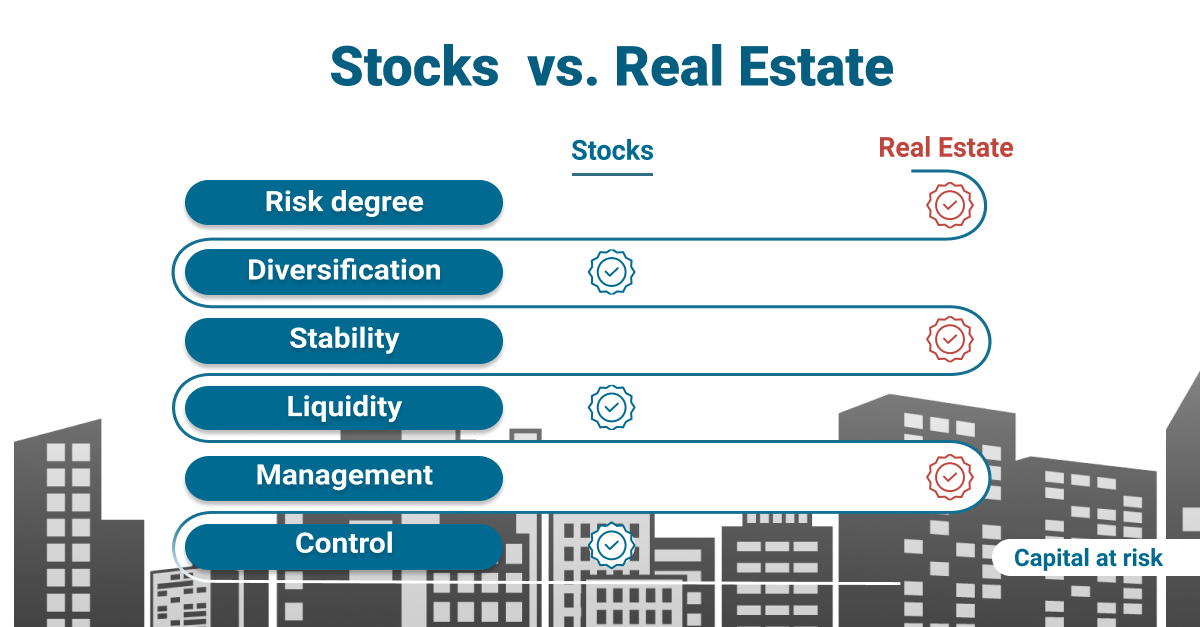

If you want to sail confidently through the investment market, you will probably aim to diversify your portfolio by investing in, among others, both stocks and real estate assets. Still, there isn’t always an opportunity to benefit from both options. So, if you had to pick, which would it be, stocks or real estate? Let’s consider how these two types of investments compare.

Risks degree

Stocks can be volatile. This is especially true in the case of an uncertain economy or if the company that owns the stocks experiences problems. It may also be difficult to invest in stocks because investors can often panic and sell when a stock drops in value. This decision usually proves impulsive and irrational. It is a challenging task to stay atop of everything going on in the market, including market trends and shifts, to achieve long-term success with stocks.

In real estate investing, the risks can be easier to foresee because you have more control over your investment. Whilst you have no control over market fluctuations, you do have the power to choose the assets, tenants and management team involved. This way, you will be able to track the performance of your investment on any given day.

Diversification

Stocks can achieve immediate diversification even if you make only a small investment. All you have to do is choose several diversified mutual funds.

Diversification in the real estate market is more complex. You will need to buy different types of assets in various locations to build a diversified investment portfolio. As each property costs a considerable amount of money, few individuals can afford the luxury of true diversification in real estate.

Stability

Movements in stock trades are quite unpredictable. It is difficult to forecast when the market is going to go up or down.

As real estate assets are less liquid and take much more time to sell to prospective buyers, there is a bigger opportunity to resist changing market cycles. It also doesn’t hurt that real estate cycles are often less volatile than stock market cycles and are thus easier to predict.

Liquidity

Stocks are typically more liquid than real estate assets because they can be purchased and sold more quickly. You can trade stocks with just a few clicks on your computer.

Real estate is more fixed. Transactions may require a lot of time to complete and always involve several stages. So, you generally can't sell a real estate asset quickly if the local market declines.

Control

It is difficult to play the stock market. Even experts find it a challenge to predict when the market is going to change. It is easier to determine when to enter and exit the real estate market because it is largely stable and predictable. While the stock market is quickly influenced by changing economic and political circumstances, changes in house prices usually occur over an extended period, giving investors time to make informed decisions. This can potentially lead to considerable profit.

Management

Stocks can be effectively managed with a more passive approach. You can buy stocks and sit back and relax. In the meantime, you will be paid any dividends with no effort required on your part. You can even set up your account so that any dividends are automatically reinvested, which is pretty convenient.

Real estate investments typically require a lot of time and effort to stay on top of. You will need to manage the asset and work with tenants, builders, property agents and so on. There is no way to automate any of these processes under the traditional real estate investment model.

In conclusion, the pros and cons of stocks and real estate investments appear to be evenly split. Investing in real estate can be less risky and more reliable and provides more room for control. In contrast, stocks tend to be more diversified, more liquid and involve less management. So, how can you enjoy all of these benefits in one investment?

Discover RealtyBundles, a property crowdfunding platform where investors can browse real estate portfolios from across the globe and invest from very little. The company's model aims to combine all the chief benefits of real estate and stock investing: stability, diversification, control over investments, a degree of liquidity, lower risk assets and less management hassle. How? Investors purchase a share in a holding company that operates real estate assets all over Europe. Learn more about the opportunities on RealtyBundles: